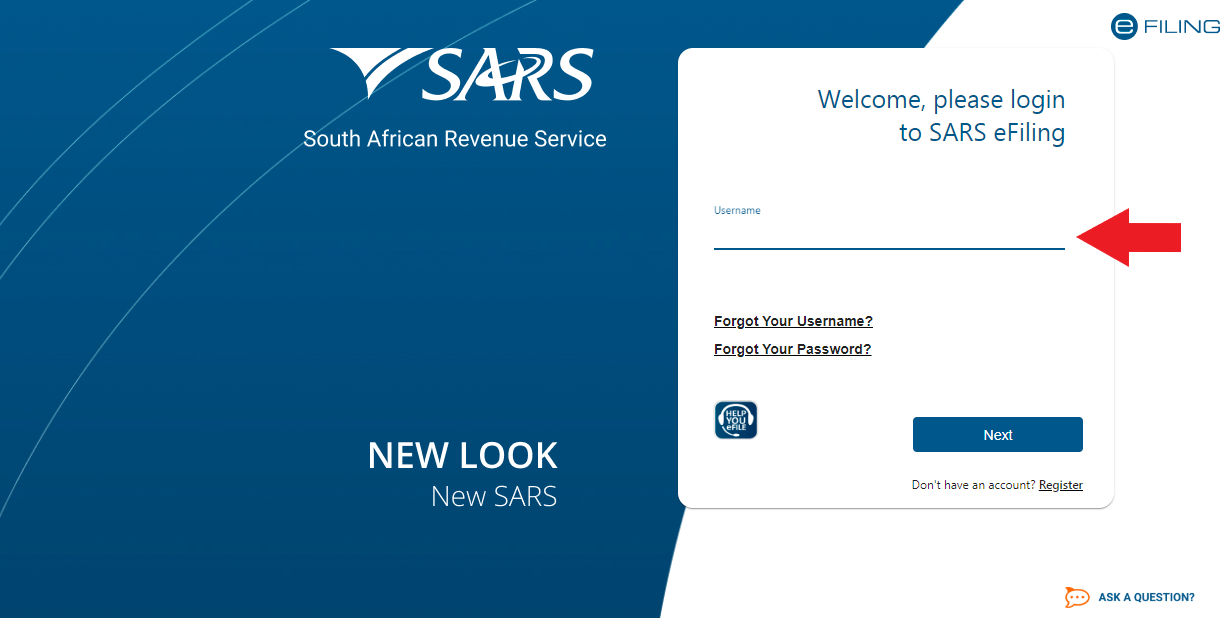

Heres how eFiling login works. SARS eFiling is a free online process for the submission of returns and declarations and other related services.

We Will Manage Your Payroll Processing On A Weekly Or Monthly Basis Catering For Sars Deductions Other Dedu Bookkeeping Services Bookkeeping Business Advisor

1 July to 28 January 2022 This is the period for Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp.

Efiling sars for business. Write down the reference numbers from SARS or if escalated to a SARS branch indicate the name of the branch date and person you escalated the case to. Steps on how to file your tax returns using eFiling and Sars new MobiApp Upon clicking on the bodys website you will be required to click on the register option after which it will display a dialogue box that will require to fill in the following details. The BSA E-Filing System supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches through a FinCEN secure network.

All complaint forms must be signed and dated. If the form does not allow you to relate your complaint fully use extra paper which must be attached to your complaint form. Redirecting to the NEW LOOK SARS eFiling.

The Office of the Tax Ombud. All information content and data on SARS websites and associated facilities including but not limited to software hyperlinks and databases is the property of or licensed to SARS and is protected under applicable South African laws. The SARS eFiling App brings simple convenient easy and secure.

Unauthorised usage of content andor information is strictly prohibited. Click here to visit the Small Business page. Business Internet Banking Please Note.

The South African Revenue Service SARS has launched a new eFiling browser in response to users complaining that they were having issues with Flash forms not loading on the eFiling. You can also call the SARS Contact Centre on 0800 00 SARS 7277 for more information or assistance with a specific query. In this article you will learn more about SARS eFiling Login after youve successfully registered for SARS eFiling.

SARS eFiling notification 24 July 2019 Payment stop order 23 July 2019 Read. SARS eFiling Login details are used to login to South African Revenue Service SARS eFiling online. Andriod App for SARS eFiling.

Tax season is open for individuals and SARS is encouraging citizens to use its eFiling system. Download SARS eFILING app for Android. Andriod App for SARS eFiling.

For small businesses the SARS website has a special section that provides information forms and other advice for small businesses. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment. Your name date of birth whether you are South African and your national Identification card number or.

We are aware of the Experian data breach which has led to a third party gaining access to consumers contact details. While the eFiling system is simple and works as. Program available in English.

Ensure that the form is completed in full. The SARS eFiling App is an innovation from the South African Revenue Service SARS that will appeal to the new generation of mobile taxpayers. If you need help to complete the Income Tax Return for Companies ITR14 on eFiling watch our helpful tutorial video by clicking on the image below.

The rand taxes and other stupidities South Africans should look out for in 2020. Taxpayers registered for eFiling can engage with. You can also call the SARS Contact Centre on 0800 00 SARS 7277 for.

With the new eFiling App taxpayers are able to complete and submit their annual Income Tax Returns quickly and easily on their smartphones tablets or iPads and receive their assessment. If you are not automatically redirected please click here. No person business or web site may reproduce this site contents information or any.

Our team is working closely with the relevant authorities to ensure that our clients are protected. Program by South African Revenue Service Lehae la SARS. While the information cannot be used to access your banking profile fraudsters may attempt to use it for phishing where they contact you.

Starting July SARS said it will be assessing a significant number. SARS tax season open Step-by-step guide on how to do your e-filing Taxpayers who cannot file online can do so physically at a SARS - but only by appointment due to the closure of physical.

How To Submit Your Income Tax Returns For Companies Itr14 On Efiling Youtube

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Register On Sars Efiling Business Tax Types Youtube

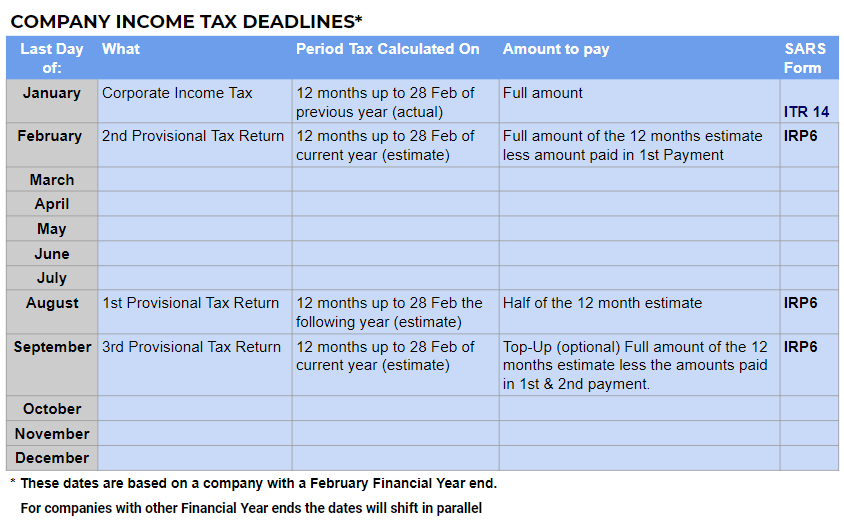

A Guide To Business Income Tax In Sa All Info Including Tax Return Deadlines And Sars Forms

Incorrect Version Of Flash Player Flash Version Incorrect

Sars Efiling How To Submit Your Itr12 Youtube

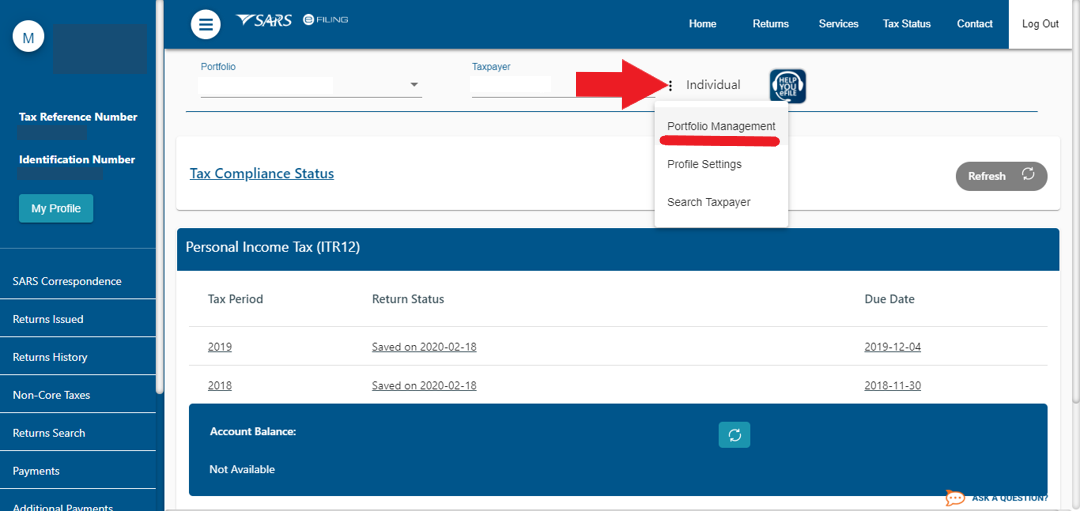

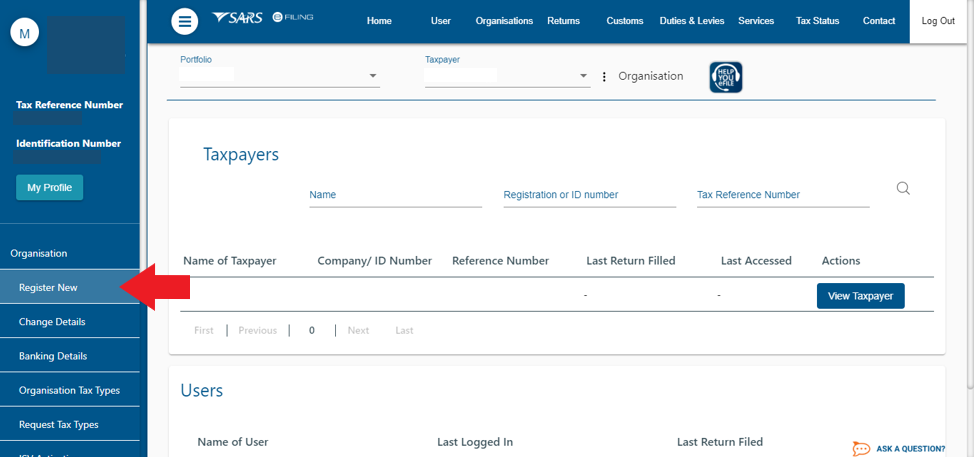

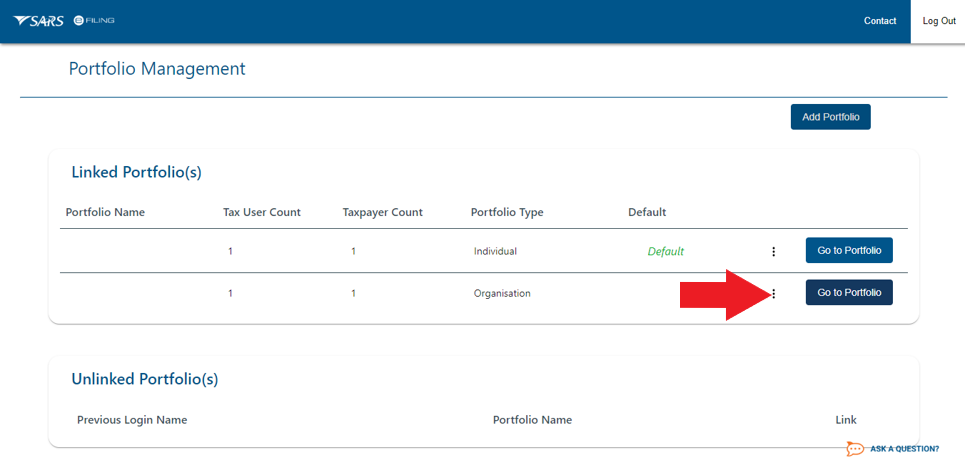

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Efiling How To Register Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

It Starts With Auto Submission Sars Filing Your Return For You And Is Only A Provisional Assessment That You Assessment Indirect Tax Financial Statement

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Mobile Efiling On The App Store

Sars Organisation Option How To Add Your Business On Efiling Youtube

E Filing File Your Malaysia Income Tax Online Imoney Income Tax Returns E Filing In 2020 Online Taxes Income Tax Income